Financial planning may be one of the single most important activities you can do to help guarantee financial security for you and your family, but it can also be difficult. After all, there are many factors to consider: your current earnings, your prospective future earnings, your current and expected future expenses, your kids, and so much more.

Figuring out where to begin your financial planning can be difficult, but this article aims to get you thinking in the right direction. We recommend taking the following into consideration while conducting your personal financial planning:

Stay Organized And Create A Financial Planning Template:

One of the secrets to successful financial planning is actually quite simple: stay organized! As mentioned above, financial planning involves combining many aspects of your life into one plan so you can secure your financial future. This means that staying organized is key.

One of the best ways to stay organized is by creating a financial planning template. This involves organizing your assets, liabilities, and more into one easy-to-read template. And don’t worry, many of these templates exist online for free for you to use. Smartsheet, for example, offers free personal financial planning templates for anyone to download. The National Endowment for Financial Education also has resources for financial planning and general financial education as well.

Start With Your Goals:

Like any project, you should start with your goals. After all, if you do not know what you are trying to achieve, how can you begin to plan?

Your goals should be quantitative and easy to measure. In other words, “Increase earnings each year” is not a real goal; it is not quantitative, specific, or easy to measure the level of success. On the other hand, “Increase investment earnings by 5 percent each year until age 65” is a measurable and specific goal.

You want your goals to be as specific as possible so you can create an in-depth plan for reaching that goal. And while you are creating specific goals, make sure these goals are attainable. In other words, set realistic expectations.

Be A Smart Consumer:

This seems obvious and is quite broad, so let’s narrow it down a bit. By “Be a smart consumer,” we mean the following:

- Stop Unnecessary Spending: Go through your spending habits and get rid of unused subscriptions. Also, try to keep “impulse buying” to a minimum. It may not seem like a lot, but small impulse purchases add up. You could be investing that money instead.

- Keep Track Of Your Debts: Keeping track of the money you owe is crucial to understanding how much money you can save each month.

- Do Your Taxes Early: Taxes can be complicated, so start your taxes early to ensure you don’t fall behind. Getting in trouble with the IRS will not help your financial planning goals!

- Maintain Good Credit: Pay your credit card bills in full and on time each month.

Get Professional Help With Your Personal Financial Planning:

As mentioned earlier, financial planning can be difficult, so it’s ok to seek out help for something as important as your family’s financial future.

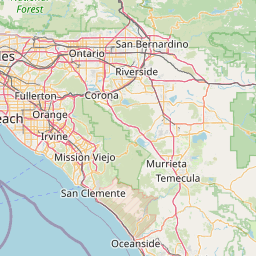

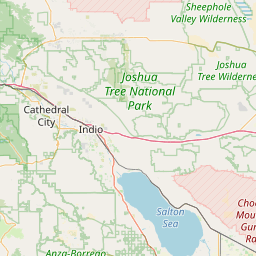

If you would like help with your financial planning, please do not hesitate to reach out. With the full range of accounting services Allman & Allman APAC provides, we are equipped with the expertise for which you may be in need. Seeking guidance from our firm will provide you the opportunity to work with individuals armed with broad and deep financial knowledge, able to provide advice on a wide range of issues. As a full-service public accounting firm, our professional services will surely help you succeed and thrive. Please feel free to reach out to Allman & Allman APAC via email at Genna@allmancpa.com or via phone at 760-773-1120 (Palm Desert) or 310-544-1120 (Rolling Hills Estates) to discuss your situation and find out how we can help you grow. We look forward to hearing from you.

HI GENNA. GAYLA and GREG DEAN here. in the spirt of Financial Planning and business organization, We need to make an LLC, or a C-Corp, or one of the other choices. Our Business , Our investment properties, and our own personal expenses are ALL under OUR OWN NAMES. Gayla Johnson and Greg Dean.

Can you help us with this?